Forex (foreign exchange) trading, with its promise of high potential returns, attracts many traders worldwide.

However, the forex market’s volatility and complexity can make it difficult to navigate without the right strategies.

Whether you’re a beginner or an experienced trader, having a well-defined trading strategy is essential for success.

In this article, we explore some of the top forex trading strategies that can help maximize your profits and minimize risks.

1. Scalping: Quick Gains from Small Price Movements

Scalping is one of the most popular short-term trading strategies, focusing on profiting from small price movements in the forex market. Scalpers aim to open and close numerous trades in a single day, often within minutes or seconds. The goal is to accumulate small profits on each trade, which can add up to significant returns over time.

How It Works:

- Scalpers target pairs with high liquidity, as these currencies tend to have small spreads.

- The strategy relies on taking advantage of small fluctuations, which can be amplified using leverage.

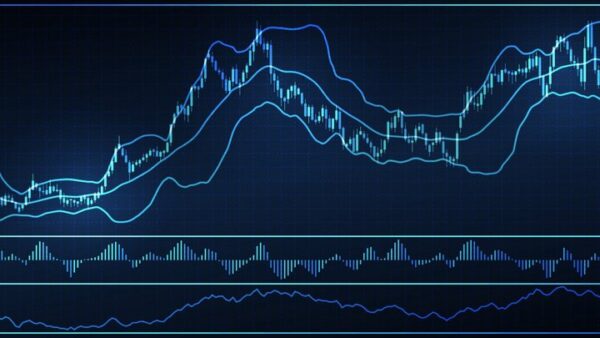

- Traders typically use indicators like the Relative Strength Index (RSI), Moving Averages (MAs), and Stochastic Oscillators to identify entry and exit points.

Risks: Scalping requires intense focus and rapid decision-making. The need to manage multiple trades can lead to errors and increased transaction costs due to frequent trades.

2. Day Trading: Capitalizing on Intraday Price Movements

Day trading involves opening and closing trades within the same trading day. Unlike scalping, day traders typically hold positions for a few minutes to several hours, aiming to profit from intraday price movements. This strategy suits traders who prefer not to leave positions open overnight, thus avoiding overnight risk.

How It Works:

- Day traders typically use technical analysis, focusing on charts and indicators like the Moving Average Convergence Divergence (MACD), RSI, and Bollinger Bands.

- News events that trigger price volatility can present opportunities for quick trades.

- Day trading can be applied to various currency pairs, but those with higher volatility, like the EUR/USD, tend to offer the best opportunities.

Risks: The main risks for day traders are overtrading and the potential for high transaction costs. Because trades are executed frequently, small mistakes can result in larger losses.

3. Swing Trading: Capturing Medium-Term Trends

Swing trading focuses on capturing price “swings” in the market. Traders look for medium-term price movements and typically hold positions for several days to weeks. This strategy allows for fewer trades compared to scalping and day trading, making it appealing for those who can’t monitor the market constantly.

How It Works:

- Swing traders use a combination of technical and fundamental analysis to identify trends.

- They often look for support and resistance levels, trendlines, and chart patterns like flags, pennants, or head and shoulders.

- Fundamental events, such as interest rate changes or political developments, may trigger price movements suitable for swing trading.

Risks: The risk of swing trading lies in its reliance on predicting price trends. Unexpected news or market reversals can lead to significant losses.

4. Position Trading: Long-Term Strategy for Trend Followers

Position trading is a long-term strategy that focuses on larger, sustained trends. Traders employing this strategy aim to profit from significant price movements over weeks, months, or even years. This is a more relaxed approach, requiring less frequent monitoring of the market.

How It Works:

- Position traders focus on identifying long-term trends using technical indicators such as Moving Averages and the Average True Range (ATR), as well as fundamental analysis.

- They often trade in the direction of the prevailing trend and may set stop-loss orders to protect against unexpected reversals.

- Major economic factors, such as central bank policies and geopolitical events, are key considerations for position traders.

Risks: The risks of position trading include holding a position for too long without adjusting for changing market conditions. This can result in missed opportunities or significant losses if the trend reverses.

5. Carry Trading: Earning from Interest Rate Differentials

Carry trading involves borrowing funds in a currency with a low-interest rate and investing them in a currency with a higher interest rate. The goal is to profit from the difference in interest rates, known as the “carry.”

How It Works:

- Traders seek currency pairs where the difference between the interest rates is significant (e.g., borrowing in JPY, which has low-interest rates, and investing in AUD, which has higher rates).

- Carry traders profit from the interest rate differential as well as any price movement in favor of the traded pair.

- This strategy is often long-term and may be used alongside technical analysis to identify entry points.

Risks: The risks of carry trading include exchange rate fluctuations, which can impact profits or lead to losses. Additionally, if interest rates change unexpectedly, the carry trade can quickly become unprofitable.

6. Breakout Trading: Capturing Price Movement After Consolidation

Breakout trading involves entering a trade when the price breaks out of a defined range or consolidation pattern. The idea is that the breakout will lead to a significant price movement, allowing traders to profit from the momentum.

How It Works:

- Traders use chart patterns like triangles, flags, and channels to identify potential breakouts.

- A breakout occurs when the price moves beyond a support or resistance level, signaling the start of a new trend.

- Breakout traders often place stop-loss orders just below the breakout point to limit potential losses.

Risks: False breakouts, where the price temporarily moves beyond a level before reversing, can lead to losses. Therefore, it’s important to have a solid risk management plan in place.

7. Trend Following: Riding the Market’s Momentum

Trend following is based on the idea that prices move in trends. Traders using this strategy aim to enter trades in the direction of the current trend and hold positions for as long as the trend continues. This strategy is popular among both short-term and long-term traders.

How It Works:

- Traders use indicators like Moving Averages, the ADX (Average Directional Index), or trendlines to identify trends.

- The key is to enter when a trend is forming and exit when signs of reversal appear.

- Many trend followers will use trailing stops to lock in profits while allowing the position to ride the trend.

Risks: The risk in trend following is that trends can sometimes reverse unexpectedly, leading to large losses. Effective risk management, such as using stop-loss orders, is crucial.

Conclusion: Choose the Strategy That Fits Your Style

No single strategy guarantees success in forex trading. Each approach comes with its own advantages and risks, and it’s important to choose one that aligns with your trading goals, risk tolerance, and level of experience.

Combining multiple strategies or tweaking them to suit your personal preferences can also be effective. Moreover, successful forex trading relies heavily on continuous learning, disciplined risk management, and a commitment to adapting to changing market conditions.

By mastering a strategy that works for you and maintaining a clear trading plan, you can maximize your potential for profits in the competitive world of forex trading.

Also Read

How to Learn Forex Trading: A Comprehensive Guide for

Why your orders are rejected on MetaTrader 5: Causes and fixes

- What Is a Pick and Pack Warehouse? A Complete Guide for Online Retailers - February 18, 2026

- Rhenus Powers South Africa’s First ScreenX Cinema with Complex Global Logistics Operation - February 18, 2026

- Yusen Logistics Expands into East Africa with Strategic Kenyan Joint Venture - February 17, 2026