Moderna’s stock plummeted by 18% on Friday after the biotech giant announced a significant reduction in its 2025 sales forecast.

The company now projects annual sales between $1.5 billion and $2.5 billion, down from the previous estimate of $2.5 billion to $3.5 billion.

This adjustment comes amid slower-than-expected adoption of its respiratory syncytial virus (RSV) vaccine and declining demand for its COVID-19 vaccines, signaling headwinds in the company’s core markets.

Revenue Challenges and Cost-Cutting Plans

The updated forecast underscores challenges faced by Moderna as it navigates a post-pandemic environment marked by dwindling demand for COVID-19 vaccines. To address these hurdles, the company plans to implement aggressive cost-cutting measures.

Moderna announced intentions to reduce cash expenses by $1 billion in 2025, with an additional $500 million cut projected for 2026. These measures aim to preserve cash reserves, which Moderna estimates will total approximately $6 billion by the end of 2025.

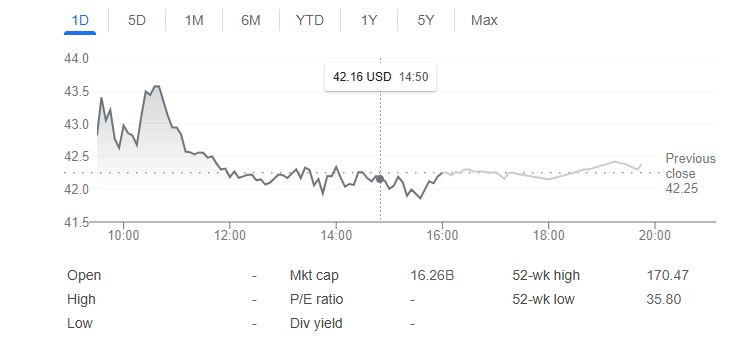

Despite these efforts, the market’s reaction was swift and severe. Shares in Moderna fell to their lowest levels since April 2020, erasing a significant portion of the company’s market capitalization.

The downturn reflects broader investor concerns over the sustainability of Moderna’s revenue streams as pandemic-driven demand wanes.

Declining Vaccine Demand

Moderna’s COVID-19 vaccines, once the cornerstone of its financial success, are no longer driving the same level of sales. The company cited weaker demand for booster shots and slower uptake of its RSV vaccine as primary contributors to the revised forecast.

\Additionally, competition in the respiratory vaccine space continues to intensify, creating further challenges for Moderna’s market positioning.

To combat these declines, Moderna is focusing on innovation. The company is developing a combination COVID-19 and influenza vaccine, which it hopes will rejuvenate interest in its product portfolio.

It is also advancing its seasonal flu vaccine and awaits FDA approval for its next-generation COVID-19 vaccine, which aims to address emerging variants more effectively.

Future Opportunities and Risks

Moderna’s pipeline includes promising candidates like its cytomegalovirus (CMV) vaccine, which is currently in late-stage trials. The company also plans to release trial data for its seasonal flu vaccine later this year.

While these developments offer hope, they may not yield significant financial results in the near term.

Analysts remain cautious, noting that Moderna’s reliance on vaccines for revenue poses risks as the market evolves.

“The sharp reduction in its 2025 sales forecast highlights how critical it is for Moderna to diversify its portfolio and accelerate the commercialization of new products,” said an industry analyst.

Broader Implications

Moderna’s revised outlook and subsequent stock drop come at a time when biotech companies are grappling with shifting market dynamics.

The announcement has sparked broader concerns about the long-term profitability of vaccine developers that saw unprecedented growth during the pandemic.

As Moderna moves forward, its ability to adapt to market challenges and deliver innovative solutions will be pivotal.

For now, however, the sharp decline in its stock price serves as a stark reminder of the volatile nature of the biotech industry and the challenges of sustaining growth in a post-pandemic world.

Also Read

U.S. Stock Futures Sink as Treasury Yields Climb and Tech Stocks DeclineRipple’s Stablecoin

Debut: A New Era for Crypto and What It Means for Ripple’s Share Price