YNAB, short for “You Need A Budget,” is a personal finance app designed to help users take control of their money through proactive budgeting.

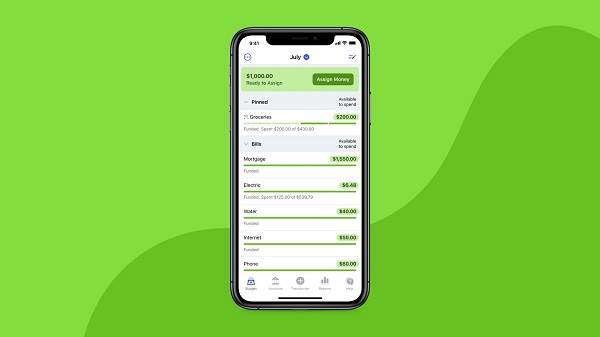

Unlike other financial apps that focus on tracking spending, YNAB emphasizes giving every dollar (or currency) a job before it is spent, aligning closely with a zero-based budgeting philosophy.

The app is widely praised for its simplicity, comprehensive tools, and a robust educational component that teaches users to rethink their relationship with money.

Commonly Asked Questions About YNAB

1. Is YNAB a free app?

No, YNAB is not free. The app operates on a subscription model:

- Cost: $14.99 per month or $99 per year (billed annually), with discounts available for students and annual subscribers.

- Free Trial: YNAB offers a 34-day free trial, allowing users to explore the app and decide whether it’s worth the investment.

While some users might hesitate at the subscription fee, many argue that the money saved using YNAB often outweighs its cost.

2. What is the purpose of the YNAB app?

The primary goal of YNAB is to help users achieve financial clarity and live within their means. It encourages users to plan their spending based on what they currently have, rather than relying on credit or future income.

YNAB’s four foundational rules guide its purpose:

- Give Every Dollar a Job: Allocate your money to specific categories (e.g., rent, groceries, savings) as soon as it enters your account.

- Embrace Your True Expenses: Break down large, irregular expenses into manageable monthly amounts to avoid financial shocks.

- Roll with the Punches: Adjust your budget as circumstances change, promoting flexibility.

- Age Your Money: Over time, aim to spend money you earned 30+ days ago, reducing reliance on paycheck-to-paycheck living.

These principles help users prioritize expenses, build savings, and manage debt effectively.

3. Does YNAB work in South Africa?

Yes, YNAB works in South Africa. However, there are some limitations:

- Currency: YNAB supports the South African Rand (ZAR), but the app does not integrate directly with South African banks. This means users need to manually import transactions or update their budgets.

- Manual Updates: While automatic bank syncing is unavailable, YNAB allows you to upload bank statements (CSV, OFX, or QFX formats) or enter transactions manually.

- Usability: South African users have reported that YNAB’s manual entry system encourages better financial awareness and control despite the lack of direct syncing.

4. What are the drawbacks of YNAB?

While YNAB is a powerful budgeting tool, it has some downsides:

- Subscription Cost: Compared to free alternatives like Mint or Goodbudget, YNAB’s pricing might deter users.

- Learning Curve: Beginners might find YNAB’s zero-based budgeting method and interface challenging initially. The app’s value is tied to the user’s willingness to stick to its philosophy.

- No Automatic Bank Sync in Some Regions: As mentioned earlier, users in countries like South Africa must manually manage transactions, which can be time-consuming.

- Limited Investment Tracking: YNAB focuses solely on budgeting and does not provide robust tools for tracking or analyzing investments.

Features and Benefits of YNAB

1. Real-Time Updates

YNAB syncs seamlessly across devices (desktop, iOS, Android) so users can update and monitor their budget on the go.

2. Goal Setting

The app allows you to set and track financial goals, such as saving for an emergency fund or paying off debt.

3. Transaction Categorization

YNAB enables precise categorization of spending, which helps users understand where their money goes and identify areas to cut back.

4. Reporting Tools

The app includes graphs and charts to visualize your financial progress, making it easier to stay motivated and assess your budgeting success.

5. Community and Education

YNAB provides webinars, tutorials, and an active online community to help users master the system and stick with it.

Who Should Use YNAB?

YNAB is ideal for:

- People who want a proactive approach to managing their finances.

- Those looking to break free from paycheck-to-paycheck cycles.

- Users willing to invest time in manual inputs (especially in unsupported regions like South Africa).

- Anyone prioritizing savings or debt elimination.

Final Verdict: Is YNAB Worth It?

If you’re looking for a structured, goal-driven approach to budgeting, YNAB is worth considering.

While its subscription fee may seem high, the app’s ability to transform financial habits often leads to greater savings and reduced stress. However, users seeking a free, automated solution may prefer alternatives like Mint or PocketGuard.

For South African users, the lack of direct bank integration is a minor inconvenience compared to the app’s overall benefits. If you’re committed to manual entry and financial discipline, YNAB can be a game-changer for your budgeting journey.

Pro Tip: Take advantage of the free trial to determine whether YNAB’s philosophy and tools fit your financial needs!

Also Read

Understanding Just-in-Time: definition, benefits, and Its role in modern supply chains

Understanding How to Lift a Credit Freeze on Equifax: A Complete Guide