SoftBank Group, the Japanese multinational conglomerate known for its aggressive investments in technology, has been making significant strides in the U.S. market.

While its roots are firmly anchored in Japan, SoftBank’s global ambitions have increasingly focused on the United States.

With high-stake investments in tech companies, artificial intelligence, robotics, and fintech, SoftBank’s investments in America reflect a calculated strategy that aligns with shifting market dynamics, technological innovation, and long-term growth opportunities.

Understanding SoftBank’s Global Vision

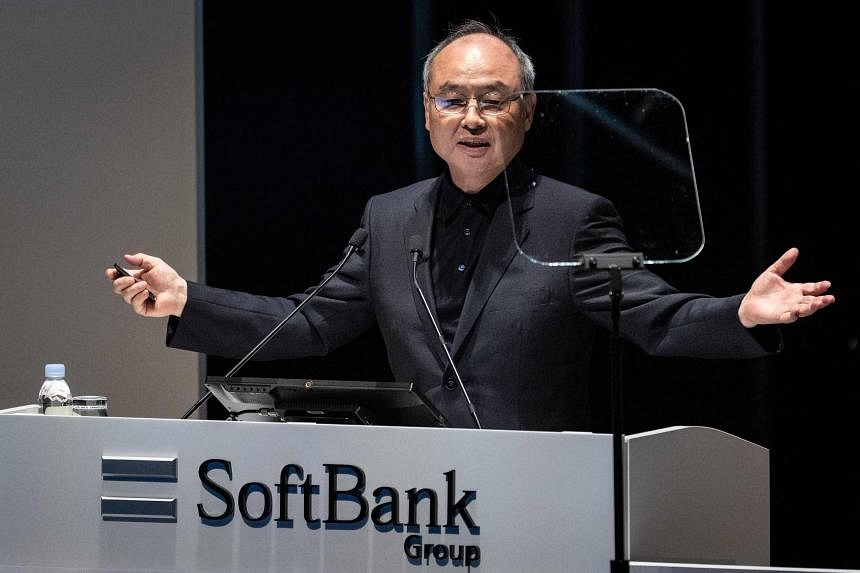

Founded by Masayoshi Son in 1981, SoftBank began as a software distributor and quickly evolved into a global investor and technology powerhouse.

The company’s Vision Fund, valued at $100 billion, is the largest tech-focused investment fund in the world. It has provided SoftBank with an unparalleled financial arsenal to invest in cutting-edge technology, including AI, e-commerce, and digital infrastructure.

America, as the world’s largest economy and a hub for technological innovation, aligns with SoftBank’s mission to fund transformative technologies and disrupt global markets.

By investing in American companies, SoftBank positions itself at the forefront of emerging industries poised to drive the next industrial revolution.

Key Reasons for SoftBank’s Investments in the U.S.

1. Access to Innovation and Technology

The United States leads the world in innovation, home to Silicon Valley and a thriving startup ecosystem. SoftBank recognizes that technological advancements in areas like artificial intelligence, biotechnology, and renewable energy often originate in the U.S.

- SoftBank’s investments in companies like Uber, WeWork, and Arm Holdings underscore its focus on revolutionary business models and technologies that reshape industries.

- The U.S. tech market also offers access to cutting-edge developments in AI, automation, and digital platforms, aligning with SoftBank’s vision of an AI-driven future.

2. Favorable Market Conditions

The U.S. economy provides a robust environment for business growth. Factors such as:

- A strong capital market system,

- Entrepreneurial culture,

- Support for venture capital and innovation hubs, create an attractive ecosystem for technology investments. SoftBank capitalizes on this environment to support high-potential startups and established businesses looking for global scale.

3. Strategic Growth Opportunities

SoftBank’s investments in the United States are not limited to technology startups. The conglomerate actively pursues opportunities in diverse sectors, including:

- Telecommunications: SoftBank’s investment in Sprint, later merged with T-Mobile, reflects its strategy to capture the growing demand for faster connectivity and digital infrastructure in the U.S.

- Robotics and AI: SoftBank-owned Boston Dynamics, a robotics company known for its futuristic machines, is headquartered in the U.S.

- Fintech: Investments in companies like Klarna and Greensill position SoftBank to dominate financial technology trends.

These investments ensure that SoftBank remains a key player in industries driving global economic transformation.

4. Diversifying Risk and Expanding Globally

For a Japanese company like SoftBank, expanding into the United States reduces its overreliance on Asian markets. Investing in diverse industries across the U.S. helps spread risk geographically while unlocking opportunities for higher returns in a stable economic environment.

SoftBank’s Landmark Investments in America

SoftBank has committed billions of dollars to the American market, targeting companies that hold disruptive potential. Some of its most notable U.S.-based investments include:

- Uber – As one of the largest investors in the ride-sharing giant, SoftBank has positioned itself in the mobility revolution.

- WeWork – Despite facing challenges, SoftBank’s continued investment in the coworking company shows its willingness to take calculated risks on emerging trends.

- Boston Dynamics – A leader in robotics innovation, advancing automation and AI integration.

- Arm Holdings – A semiconductor and software design company integral to global tech infrastructure.

These investments reflect SoftBank’s focus on future-proof industries with scalable potential.

Challenges SoftBank Faces in America

While SoftBank’s American investments have been transformative, the company has faced notable challenges:

- Regulatory Scrutiny: As a foreign investor, SoftBank’s acquisitions and deals undergo significant regulatory review to ensure compliance with U.S. economic and security policies.

- High-Risk Ventures: SoftBank’s aggressive investments in unproven startups, like WeWork, have led to substantial financial setbacks.

- Competition: Competing against established venture capital firms in the U.S. requires SoftBank to continually demonstrate value and strategic foresight.

Despite these hurdles, SoftBank’s willingness to take risks and its substantial financial resources enable it to adapt to challenges and identify new opportunities.

SoftBank’s Future in America

Looking ahead, SoftBank is expected to intensify its focus on industries that shape the digital economy, including:

- Artificial Intelligence and Automation: AI is central to SoftBank’s vision, and U.S.-based companies remain at the forefront of AI innovation.

- Green Energy: With growing demand for sustainable energy solutions, SoftBank is likely to target American companies that develop clean energy technologies.

- Digital Infrastructure: SoftBank’s push for faster connectivity, 5G networks, and digital ecosystems aligns well with American market demands.

By strategically identifying and investing in transformative industries, SoftBank will continue to play a crucial role in shaping the U.S. and global economic landscape.

Conclusion

SoftBank’s investment strategy in the United States underscores its commitment to technological innovation, global expansion, and long-term value creation.

By targeting high-potential sectors such as AI, fintech, and robotics, SoftBank leverages the U.S.’s thriving entrepreneurial environment to advance its vision of the future.

While challenges remain, SoftBank’s ability to balance risk, adapt to market conditions, and fund groundbreaking technologies positions it as a leading investor in America.

As industries continue to evolve, SoftBank’s strategic moves in the U.S. will play a pivotal role in driving technological advancement and economic growth on a global scale.

Also Read

The state of IonQ stock: Growth amidst volatility

Why Google stock (GOOG) is a strong choice for long-term investors