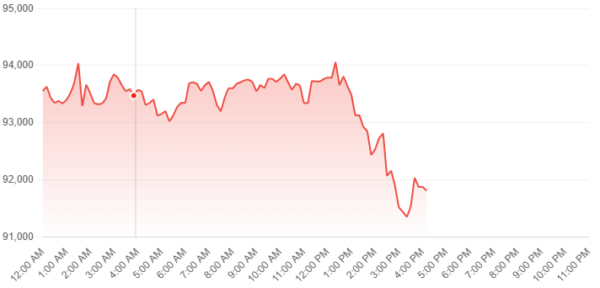

As 2024 draws to a close, Bitcoin’s remarkable rally appears to be losing momentum. After reaching a record high of over $103,000 in mid-December, the cryptocurrency’s price has declined to approximately $91,879, signaling a significant slowdown.

Profit-Taking and Market Sentiment

A significant factor behind Bitcoin’s recent dip is profit-taking. Many investors who had bought Bitcoin during its early-year rally took advantage of the coin’s lofty prices, cashing out their profits as the year neared its end. This sell-off, coupled with a general cooling of speculative trading, has contributed to the downward pressure on the price.

Moreover, a growing caution among investors has played a role in the market’s shift. After a year of robust gains, Bitcoin’s volatility has led some to question whether it can maintain such aggressive price increases. As a result, some market participants have been hesitant to further fuel the rally.

Institutional Interest and Long-Term Prospects

Despite the recent pullback, the long-term outlook for Bitcoin remains promising, according to analysts. Bitcoin’s price has still more than doubled from the beginning of the year, and institutional interest in cryptocurrency continues to grow. Companies like MicroStrategy, Tesla, and others have made large purchases of Bitcoin, which could help provide support for the cryptocurrency’s price.

Additionally, Bitcoin’s role as a store of value is being reassessed by investors, and with growing support from global companies and even nations exploring digital currencies, the outlook for Bitcoin in the years to come remains strong, despite short-term fluctuations.

Looking Ahead: What’s Next for Bitcoin?

As 2024 ends, Bitcoin’s price may be facing a slowdown, but the outlook for 2025 and beyond remains cautiously optimistic. Analysts suggest that Bitcoin may stabilize at current levels or even see a renewed push if institutional buyers continue to show interest. With global financial uncertainties and the increasing role of digital assets in the global economy, Bitcoin could continue to play a significant role in the financial landscape in the coming years.

However, for now, Bitcoin investors are left to wonder if the rally that captured headlines earlier this year was simply a peak before the inevitable correction, or the start of a broader, more sustainable market movement in the years ahead.

Also Read

Top Performers: Stocks Defying the Trend as 2024 Draws to a Close

Stock Market Update: S&P 500 and Nasdaq Post Modest Declines Amid Year-End Volatility