Quicken Simplifi is a modern personal finance management tool designed to simplify budgeting, tracking expenses, and planning for the future.

Launched by Quicken, a trusted name in personal finance software, Simplifi is a cloud-based solution aimed at users seeking a sleek, easy-to-use platform for day-to-day financial management.

This review explores Simplifi’s features, its usability for Canadian users, and how it compares to the more traditional Quicken software.

Overview of Quicken Simplifi

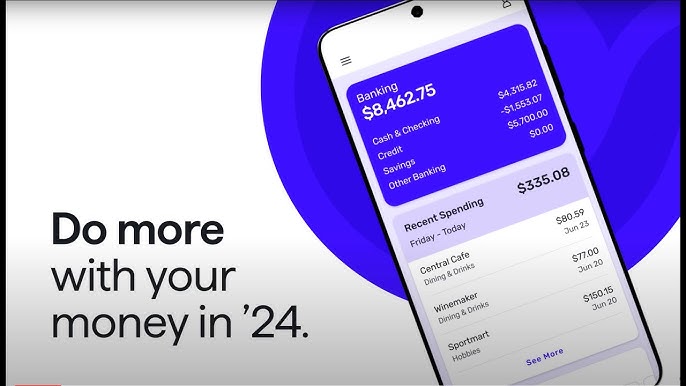

Simplifi is designed for simplicity and accessibility. Unlike the desktop-based Quicken software, Simplifi operates entirely online and through mobile apps (iOS and Android), making it a flexible solution for users on the go. It focuses on four key areas:

- Budgeting: Create and manage budgets easily using customizable spending categories.

- Tracking Expenses: View your transactions in real time and identify spending trends.

- Goal Setting: Set and monitor financial goals, such as saving for a home or paying off debt.

- Cash Flow Forecasting: Gain insights into your financial future with predictive cash flow tools.

Does Quicken Work for Canadians?

Yes, Quicken works for Canadians. The company offers a Canadian-specific version of its traditional software, which is tailored to Canadian tax codes, currency, and banking systems. This version integrates seamlessly with Canadian financial institutions, allowing users to track accounts and manage finances locally.

However, Simplifi by Quicken does not currently offer the same level of integration for Canadians as the desktop Quicken product. Simplifi supports a range of Canadian banks, but the platform is optimized for U.S. users. Canadian users may encounter issues with certain features like automatic currency conversions or bank account linking for less common institutions.

Can I Use Quicken US in Canada?

Yes, but with limitations. The U.S. version of Quicken can be used in Canada, but it is not tailored to Canadian-specific requirements, such as CRA tax codes or CAD currency integration.

Canadian users of the U.S. version might need to manually input data or find workarounds for features like tax reporting and currency management. Simplifi, on the other hand, operates independently of these regional constraints due to its focus on basic personal finance tracking.

Does Quicken Work with Canadian Banks?

Simplifi supports connections to many major Canadian banks, including RBC, TD, Scotiabank, and others. However, not all banks are supported, and users may occasionally experience syncing issues.

If you have accounts with smaller or region-specific Canadian banks, you may need to manually input transactions.

The desktop version of Quicken Canada offers broader and more reliable support for Canadian banks compared to Simplifi, making it a better choice for users who rely on robust banking integration.

How Is Simplifi Different From Quicken?

Simplifi and Quicken serve different purposes and audiences:

| Feature | Simplifi | Quicken |

|---|---|---|

| Platform | Cloud-based, mobile-focused | Desktop-based with cloud sync option |

| Target Audience | Users seeking simplicity and mobility | Comprehensive users (e.g., investors, property managers) |

| Bank Integration | Basic support for U.S. and Canadian banks | Full support tailored to U.S. or Canada |

| Tax Tools | None | Includes tax planning and reporting tools |

| Investment Tracking | Limited | Robust (U.S. and Canadian-specific) |

| Cost | Monthly subscription (~$3.99–$5.99/month) | One-time or subscription cost |

Simplifi is perfect for users who want a simple, clean, and modern tool for tracking personal finances. Quicken, however, remains the choice for those needing advanced features like investment tracking, property management, or Canadian-specific tax tools.

Pros and Cons of Simplifi

Pros

- User-Friendly Design: Intuitive and easy to navigate, ideal for beginners.

- Cross-Platform Support: Available on mobile apps and web browsers.

- Real-Time Updates: Automatically syncs with linked accounts for real-time insights.

- Affordable Subscription Model: Lower upfront cost compared to Quicken desktop versions.

Cons

- Limited Canadian Functionality: Not as robust for Canadian users as Quicken Canada.

- No Tax Tools: Simplifi doesn’t support tax reporting or optimization.

- Investment Tools Are Basic: Designed more for cash flow tracking than portfolio management.

- Syncing Issues: Occasional challenges with bank connections, particularly for non-U.S. users.

Conclusion: Should Canadians Use Simplifi?

Quicken Simplifi is a great tool for managing personal finances in a simple and accessible way, but it’s not ideal for Canadian users who require robust banking integrations or tax-specific features.

If you’re in Canada and your needs are basic—budgeting, tracking expenses, and monitoring cash flow—Simplifi could be sufficient.

For users needing a comprehensive solution tailored to Canada, the desktop version of Quicken Canada is a better fit.

It offers deeper functionality, reliable support for Canadian banks, and tools for tax planning and investments.

If you’re a Canadian looking for seamless integration and advanced features, consider Quicken Canada.

However, for those seeking a mobile-friendly, minimalist approach to finance management, Simplifi is worth exploring.

Also Read

In-Depth review of YNAB (You Need A Budget) app

Understanding How to Lift a Credit Freeze on Equifax: A Complete Guide