The U.S. airstrikes on Iran’s nuclear facilities on June 22, 2025, mark a turning point in both geopolitics and global energy markets.

As tensions rise in the Gulf, the oil market—already jittery from earlier regional instability—is bracing for seismic shifts.

Here’s how the situation could play out across supply chains, pricing, and long-term investment strategies.

1. Immediate Price Spike: Volatility Returns

Brent crude futures surged nearly 12% overnight, breaching the $105 per barrel mark as news of the strikes broke.

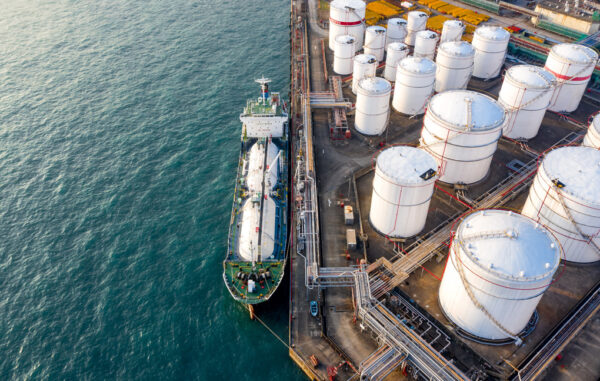

WTI followed closely, fueled by fears of supply disruptions through the Strait of Hormuz—a chokepoint through which nearly 20% of global oil flows daily.

Stephen Innes, managing partner at SPI Asset Management, noted:

“For markets, this shatters the illusion of containment… unpredictable spillovers across energy markets, global shipping lanes, and risk sentiment.”

James Bambino, senior oil analyst at S&P Global, echoed the concern: “The key question is what comes next… Will Iran attack shipping in the Strait of Hormuz?”

This uncertainty is further inflaming speculative sentiment in the futures market. Traders are betting on prolonged conflict and tightening supplies, adding upward pressure on prices.

2. Supply Chain Vulnerability: Strait of Hormuz in Focus

The Strait of Hormuz remains the market’s pressure point. If Iran retaliates by mining or temporarily blockading the strait, even partially, it could cripple exports from:

-

Saudi Arabia

-

Iraq

-

UAE

-

Kuwait

-

Qatar (LNG)

Even a symbolic threat could force oil tankers to reroute or halt, removing millions of barrels per day from the market and risking a global energy crunch.

According to Reuters, prices could spike by $3–$5 per barrel when markets reopen, with analysts warning of a potential surge to $100 if the strait is disrupted.

3. OPEC and Strategic Reserves: A Balancing Act

In response, OPEC (especially Saudi Arabia) may be pressured to raise production to stabilize prices. However:

-

Spare capacity is limited and cannot fully cover the shortfall if Iranian exports are disrupted.

-

Saudi infrastructure remains vulnerable to drone/missile strikes, as evidenced during the Abqaiq attack (2019).

The U.S. and allies may tap into Strategic Petroleum Reserves (SPR) to offset short-term shocks. But analysts at JP Morgan warn that “sustained conflict would outpace temporary reserve measures,” underlining the fragility of current contingency plans.

4. Iran’s Oil Export Game: Ghost Tankers & Sanctions Pressure

Iran’s current oil exports—mostly to China via ghost fleet tankers—face renewed scrutiny. If the U.S. reimposes stricter sanctions or ramps up maritime patrols:

-

Iran’s 1.5 million bpd exports could drop sharply.

-

China may be forced to seek alternative suppliers, disrupting existing trade flows and raising prices in the Asian market.

Rabobank analysts suggest that even though Iran relies on the Strait of Hormuz for its own exports, “the temptation to retaliate with shipping disruption remains high,” further compounding market tension.

5. Long-Term Implications: Investment & Transition Acceleration

The strikes could catalyze a series of longer-term shifts:

-

Investment Boost in U.S. Shale: Higher prices may incentivize increased output, especially from the Permian Basin.

-

Energy Transition Tailwind: The geopolitical fragility of oil supply may push policymakers to accelerate renewables, EVs, and battery storage.

Landon Derentz, director at the Atlantic Council Global Energy Center, remarked: “This reflects a deeper transformation in the global energy landscape… The absence of antagonism from Gulf Arab partners has created a new baseline of resilience in Middle East energy markets.”

Still, most analysts agree a $5–$10 geopolitical risk premium is now baked into crude benchmarks for the foreseeable future.

A Precarious Balance

The U.S. bombing of Iranian nuclear sites has thrown the oil market into a high-stakes geopolitical gamble. While actual supply disruptions remain speculative for now, the psychological impact on markets is real—and potent.

Prices will remain volatile in the near term, and the global economy, already contending with inflationary pressures, must prepare for a prolonged period of energy uncertainty.

As Stephen Innes put it, the strikes have “shattered the illusion of containment”—ushering in a new phase of global oil insecurity.

Also Read

- What Is a Pick and Pack Warehouse? A Complete Guide for Online Retailers - February 18, 2026

- Rhenus Powers South Africa’s First ScreenX Cinema with Complex Global Logistics Operation - February 18, 2026

- Yusen Logistics Expands into East Africa with Strategic Kenyan Joint Venture - February 17, 2026