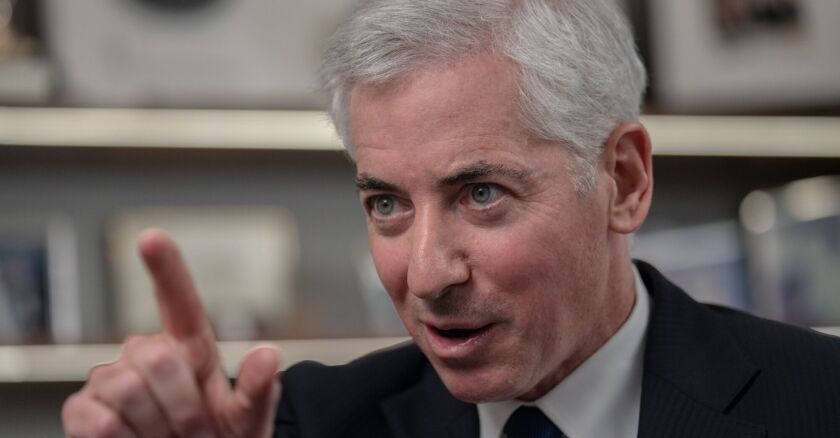

Renowned hedge fund manager and billionaire Bill Ackman is making headlines once again with bold moves in his investment portfolio.

The founder of Pershing Square Capital Management has placed significant bets on two well-known companies, Brookfield Corporation and Nike, signaling his confidence in their long-term potential despite volatile market conditions.

A Fivefold Bet on Brookfield Corporation

Ackman’s most striking move involves Brookfield Corporation, a global asset management firm known for its investments in real estate, renewable energy, infrastructure, and private equity.

Ackman has increased his stake in the company fivefold since June 2024, amassing a total of 22 million shares. This hefty acquisition now constitutes approximately 14.4% of Pershing Square’s $13.4 billion portfolio.

Brookfield’s diversified business model and robust performance in asset management appear to align with Ackman’s investment philosophy. By significantly boosting his position, he underscores his belief in Brookfield’s ability to deliver steady returns, particularly in sectors resilient to economic downturns.

Nike: A 440% Leap of Faith

In another bold move, Ackman has dramatically increased his holdings in Nike, the iconic sportswear and footwear company. Between June and September 2024, his stake in Nike soared by 440%, demonstrating a strong conviction in the brand’s enduring appeal and growth prospects.

This comes despite recent headwinds for Nike, including a 14% drop in its stock value since September.

The decline, attributed to sluggish sales in key markets and supply chain challenges, has not deterred Ackman. Instead, he views the dip as an opportunity to double down on a company with a storied history and a strong foothold in the global market.

A Calculated Strategy

These investments reflect Ackman’s preference for companies with strong fundamentals, global reach, and the potential for long-term value creation.

His increased stake in Brookfield suggests confidence in the stability of asset management and infrastructure, while his Nike investment highlights faith in the resilience of consumer brands.

Both moves come at a time when Ackman is recalibrating his portfolio, which also includes prominent positions in Hilton Worldwide, Lowe’s, and Universal Music Group. While he reduced his stake in Hilton by 18% recently, his commitment to Brookfield and Nike underscores his focus on sectors with promising growth trajectories.

Looking Ahead

Bill Ackman’s strategic investments in Brookfield Corporation and Nike underscore his ability to identify and act on opportunities in both stable and dynamic sectors. As markets continue to navigate uncertainty, Ackman’s confidence in these two companies could serve as a barometer for other investors seeking guidance in turbulent times.

Time will tell if these bold moves pay off, but one thing is clear: Ackman’s calculated risks and unwavering confidence in these giants of industry reaffirm his status as one of the most influential investors of our time.

Also Read

Federal Reserve expected to lower borrowing costs amid economic uncertainty

Pudgy Penguins NFT floor price plummets almost 50% following PENGU launch