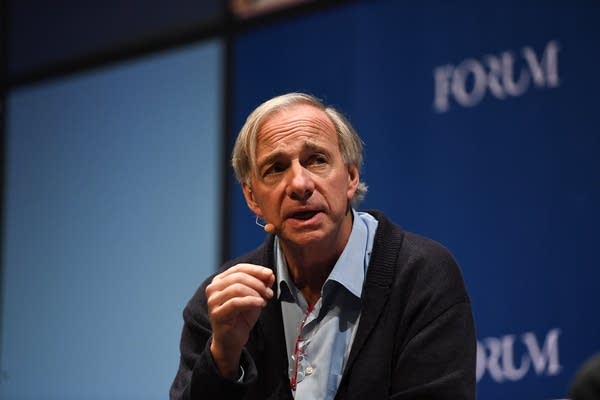

Renowned billionaire investor and founder of Bridgewater Associates, Ray Dalio, has issued a stark warning that’s sending ripples through financial and political circles.

In a recent interview, Dalio cautioned that the United States may be on the brink of something “worse than a recession,” triggered by escalating trade tensions, ballooning debt, and policy missteps.

A New Red Flag from Wall Street’s Oracle

Ray Dalio is no stranger to economic forecasting. As the mastermind behind the world’s largest hedge fund, he’s seen—and predicted—some of the most significant financial events of the last 50 years. But his latest outlook? It’s bleaker than usual.

In an April 2025 appearance on NBC’s Meet the Press, Dalio voiced concerns that the U.S. could enter an economic phase far more damaging than a standard downturn, driven in part by former President Donald Trump’s recent 145% tariff hike on Chinese imports.

“What worries me is not just a recession,” Dalio said. “It’s a potential breakdown of the monetary system, reminiscent of 1971 and 2008.”

The Triggers: Trade Wars, Debt Explosions, and Global Tensions

Dalio’s warning hinges on a cocktail of economic stressors that he believes are converging dangerously:

-

Massive Tariffs on China: He argues that Trump’s aggressive tariffs risk destabilizing global supply chains and inviting retaliatory actions, leading to trade war escalation.

-

Ballooning U.S. National Debt: With the U.S. debt-to-GDP ratio climbing, Dalio fears the Federal Reserve may lose control over inflation and interest rates.

-

Geopolitical Uncertainty: From strained U.S.-China relations to global conflicts, Dalio believes rising nationalism and polarization are contributing to global instability.

“Something Worse Than a Recession”: What Does He Mean?

While recessions involve negative GDP growth and job losses, Dalio’s warning goes further. He’s concerned about a systemic breakdown:

-

Collapse of confidence in U.S. Treasury bonds

-

Breakdown of international monetary cooperation

-

Runaway inflation or stagflation

-

Political paralysis preventing effective economic solutions.

“If the bond market loses faith in the dollar, we could be in uncharted territory,” Dalio noted

A Call for Bipartisanship and Balance

Dalio didn’t just sound the alarm—he also offered advice. He emphasized the need for coordinated fiscal discipline, stronger international cooperation, and domestic political unity to weather the storm.

He specifically urged U.S. leaders to:

-

Rein in budget deficits

-

Avoid politically motivated economic policies

-

Prioritize long-term structural reforms over short-term fixes

Final Thoughts: Will the Warning Be Heeded?

Ray Dalio’s voice carries weight not just because of his track record, but because he sees the macroeconomic chessboard several moves ahead. Whether policymakers take action—or double down on risky strategies—remains to be seen.

What’s clear is that when Dalio speaks, markets—and governments—would do well to listen.

Also Read

Rangel’s Bold Bet on South Africa: What It Means for Regional Logistics

Rangel’s Bold Bet on South Africa: What It Means for Regional Logistics