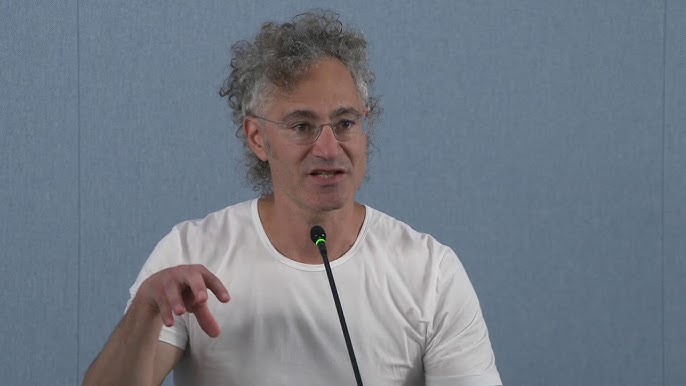

In a strategic financial maneuver, Palantir Technologies’ CEO, Alexander Karp, has adopted a Rule 10b5-1 trading plan to sell up to 9,975,000 shares of the company’s stock by September 12, 2025.

Based on recent trading prices, this sale could amount to approximately $1.23 billion. This plan supersedes a previous arrangement that permitted the sale of up to 48.9 million shares, which was canceled on November 22, 2024.

The implementation of a Rule 10b5-1 trading plan allows executives to sell predetermined amounts of stock at specified times, thereby reducing concerns about insider trading. In 2024, Karp sold a total of 40.7 million shares, generating $1.95 billion, with an average price of $47.99 per share.

This decision comes on the heels of a remarkable surge in Palantir’s stock performance. In the fourth quarter of 2024, the company’s shares doubled in value, significantly outperforming the S&P 500 index, which saw a modest 2% gain during the same period.

This upward trajectory has continued into 2025, with Palantir’s stock appreciating over 60%, while the S&P 500 has risen by approximately 4%.

Several factors have contributed to this impressive growth. Analysts attribute the surge to Palantir’s higher-than-expected revenue projections for 2025 and the integration of Grok, a chatbot developed by Elon Musk’s xAI, into its AI platform.

This development has resonated particularly well with retail investors, who have played a significant role in driving the stock’s momentum. Over a one-week period ending February 11, 2025, retail investor purchases amounted to $339.72 million, positioning Palantir among the top three companies favored by this investor segment, alongside Nvidia and Tesla.

Despite the bullish trend, some market observers advise caution. The stock is currently trading at a valuation 75 times the expected sales for this year, leading to concerns about sustainability and future growth. Analysts caution that Palantir’s growth rate may slow down, which could negatively impact its stock price.

Technical analysis shows that Palantir’s stock has historically declined after reaching new highs. Some analysts have even set lower price targets, reflecting a more conservative valuation.

As of February 19, 2025, Palantir’s stock price stands at $112.06, reflecting a slight decrease of 0.10% from the previous close.

The intraday high reached $125.39, with a low of $108.65, indicating ongoing volatility in the stock’s performance.

In summary, Alexander Karp’s substantial stock sale plan emerges amidst a period of significant growth and heightened investor interest in Palantir Technologies.

While the company’s advancements in AI and strategic partnerships have bolstered its market position, the elevated stock valuation suggests that investors should exercise due diligence and consider potential risks alongside growth prospects.

Also Read

- What Is a Pick and Pack Warehouse? A Complete Guide for Online Retailers - February 18, 2026

- Rhenus Powers South Africa’s First ScreenX Cinema with Complex Global Logistics Operation - February 18, 2026

- Yusen Logistics Expands into East Africa with Strategic Kenyan Joint Venture - February 17, 2026