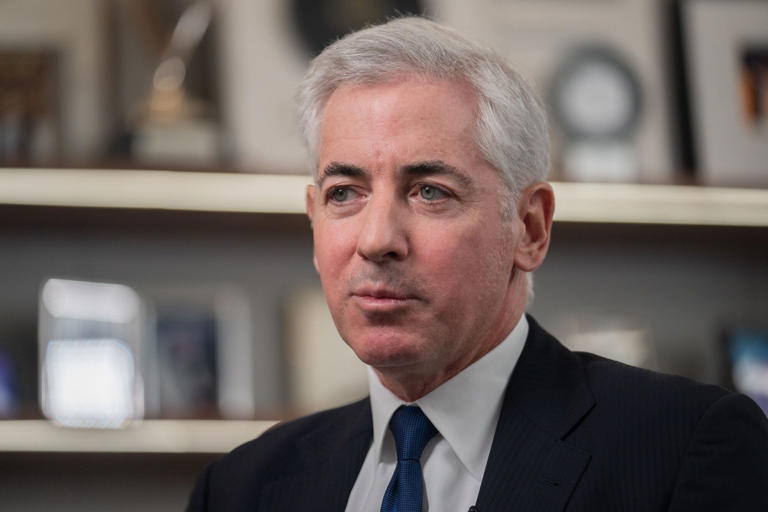

Bill Ackman, the billionaire investor and CEO of Pershing Square Capital Management, has announced plans to consolidate ownership of Howard Hughes Holdings by acquiring the shares his firm does not already own.

The offer, which values Howard Hughes at $85 per share, represents a significant premium over its recent closing price of $71.78, signaling Ackman’s confidence in the company’s long-term potential.

The Proposal Details

Pershing Square, which already owns nearly 38% of Howard Hughes Holdings, intends to create a merger subsidiary under Pershing Square Holdco, L.P.

The new entity will merge with Howard Hughes Holdings, making the latter a privately-held company.

Shareholders will have the option to receive their payout in cash or to retain a stake in the post-merger organization by rolling over their shares.

Ackman’s vision for Howard Hughes involves transforming it into a “modern-day Berkshire Hathaway,” utilizing its substantial real estate portfolio, including assets in Texas, Las Vegas, and Hawaii, to generate cash flow for future investments.

Market Reaction

The market reacted positively to the announcement, with Howard Hughes shares surging by more than 10% in pre-market trading, climbing close to $80 per share. This sharp uptick reflects investor optimism about Ackman’s proposal and the premium offered over the current market valuation.

“This deal underscores Ackman’s belief in the underappreciated value of Howard Hughes’ assets,” said one analyst. “The premium signals a bullish outlook for the company’s future growth.”

Strategic Implications

If successful, the acquisition will allow Ackman to execute a long-term strategy without the constraints of public market pressures.

By leveraging the company’s steady cash flow from its master-planned communities and other real estate developments, Pershing Square aims to position Howard Hughes as a powerhouse in the real estate sector.

Next Steps

The proposal is subject to regulatory approvals and agreement by Howard Hughes’ independent board members.

While the offer has garnered significant attention, it remains to be seen how other stakeholders will respond.

In the meantime, the share price rally reflects strong market sentiment and the potential for increased value under Ackman’s leadership.

Howard Hughes shareholders, particularly those considering rolling over their shares, are poised to play a key role in shaping the company’s future.

Also Read

Moderna’s Stock Plunges 18% as Company Slashes 2025 Sales Forecast by $1 Billion

U.S. Stock Futures Sink as Treasury Yields Climb and Tech Stocks Decline